www.tax.ny.gov.starcheck

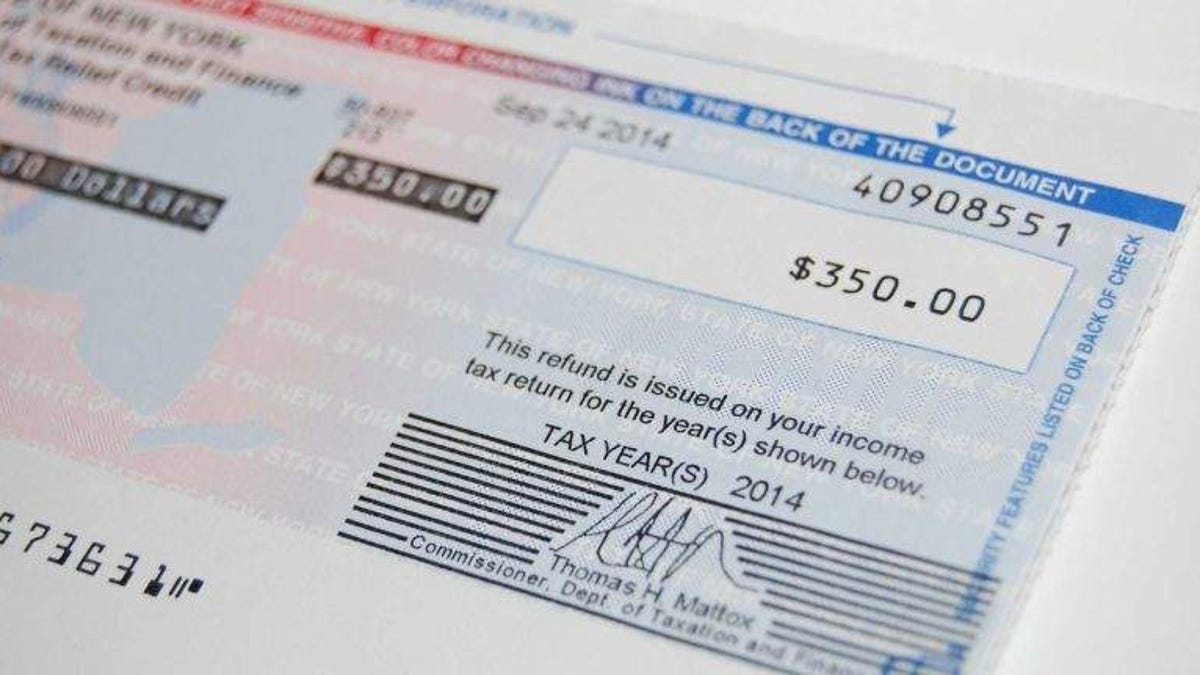

The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners. Refund checks also contain a letter P or W in the upper right hand corner and will contain one signature by the State Comptroller.

STAR NYS School Tax Relief Program provides tax relief off of your School Tax for your primary residence but you need to apply for it.

. We get a reduction in our property tax called STAR on our property tax bills. Ad Download Or Email NY RP-425 More Fillable Forms Register and Subscribe Now. If you are using a screen reading program select listen to have the number announced.

To use the lookup. Comptroller State of New York - Refund Account. Enter the security code displayed below and then select Continue.

Lf you have applied for the STAR check and are eligible but still have not received your check you may check the status of your check with. The STAR Check Delivery Schedule lookup provides the most recently updated information available for your area. Get Form 1099-G for tax refunds.

The following security code is necessary to prevent unauthorized use of this web site. External web sites operate at the direction of their respective owners who should be contacted directly with questions regarding the content of these sites. Go to navigation Go to content.

If you received an income tax refund from us for tax year 2020 view and print New York States Form 1099-G on our website. The New York State Department of Tax and Finance has created a new website allowing homeowners to search for STAR check mailing dates. Income Tax Refund Status.

Please try again later. If you are eligible and enrolled in the STAR program youll receive your benefit each year in one of two ways. The following security code is necessary to prevent unauthorized use of this web site.

The STAR program can save homeowners hundreds of dollars each year. All Exemption Applications are due by March 1st. If youre a homeowner in New York you could get a school tax rebate this fall just in time for elections.

So if I paid 3000 in real estate taxes portion of my annual maintenance which went to pay real estate taxes and I received an annual STAR credit of say 1500 I can only deduct 1500 as real estate taxes. Your income needs to be below 500000 to qualify. The School Tax Relief STAR and Enhanced School Tax Relief E-STAR benefits offer property tax relief to eligible New York State homeowners.

Register for the Basic and Enhanced STAR credits. The Online Services is currently unavailable. Who Can Apply Homeowners not currently receiving the STAR exemption who meet the programs eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and.

If you are registered for the STAR credit the Tax Department will send you a STAR check in the mail each year. STAR Check Delivery Schedule. Visit Department of Labor for your unemployment Form 1099-G.

Select your school district to view the information for your area. There are two types of STAR. If you are a new homeowner please remember to go online and apply for STAR as soon as possible.

Enter the security code displayed below and then select Continue. If you are using a screen reading program select listen to have the number announced. The basic STAR credit.

The State of New York does not imply approval of the listed destinations warrant the accuracy of any information set out in those destinations or endorse any opinions expressed therein. While the website does not specifically advise when a check will arrive it provides notice of when checks have been mailed to homeowners in individual school districts. We get a check - this year mailed out to many on Dec 31 2019 rather than direct deposited as NYS could easily do of a property tax rebate from the state.

For those of you who wonder about real estate taxes and co-ops each month our maintenance is reduced by monthly pro-rated star credit. The state Department of Taxation and Finance is mailing out more than 130000 STAR checks throughout the state. New york state department of taxation and finance september 15 at 1250 pm tax department announces deadline extension for certain business and.

Most residents have reported receiving their checks over the last two weeks. You may need to report this information on your 2021 federal income tax return. Assessor Star the school tax relief program was created by gov.

Kathy Hochul has asked. Select your town or city. The following security code is necessary to prevent unauthorized use of this web site.

See the STAR resource center to learn more. Select Delivery Schedule lookup below. Choose the county you live in from the drop-down menu.

Its important to know exactly what these changes are and. If you are using a screen reading program select listen to have the number announced. Lf you purchased your house after 2015 and have applied with NYS to receive a STAR check you will receive a check in the mail.

If you are using a screen reading program select listen to have the number announced. Vendor checks have two signatures on the check one from the State Comptroller and one from the Commissioner of Tax and Finance. A department spokesman said it.

How new york just made it easier to get a check. Lets start from scratch. You only need to register once and the Tax Department will send you a STAR credit check each year as long as youre eligible.

The following security code is necessary to prevent unauthorized use of this web site.

09 13 21 Assessment Community Weekly

What Does Saved In Star Savings Mean In Google The Nina

Rebate Checks Gone In Nys Star Checks Continue For Now Yonkers Times

Search For Star Check Delivery Status Ny State Senate

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Xii 9 G Reissuing Or Cancelling A Refund Check

2 Exemptions Town Of Clarence Ny

Water And Tax Town Of Piercefield

Rebate Checks Are Coming What To Know This Year Wgrz Com

Gaughran Guthman To Lead Star Discussion Huntington Now Huntington Ny Local News

.svg)